Payroll

People Management

No cutting cheques anymore. Send employees’ pay straight into their bank accounts.

Give employees detailed pay stubs that show deductions, YTD information, reimbursements, and more—always available in Rise HR or the mobile app.

Employees can access pay stubs and T4s online, on the mobile app, or by email.

Create departments for employees and contractors for better reporting and management.

Create time off policies that track employee vacation, time off, and sick leave balances, so you don’t have to.

Update information just once. Any changes to an employee’s salary or hourly rate are automatically applied everywhere.

Let employees allocate their pay between multiple bank accounts.

Payroll Administration

Automate payroll deductions and calculations.

Preview pay stubs and your work before finalizing a pay run.

Upload earnings such as bonuses, tips, and commissions in one go.

Pay contractors and automatically file and remit taxes.

Create your own earning codes for extra flexibility.

Stay on top of expenses with detailed department-by-department cost breakdowns.

Pay employees at different rates based on multiple positions in each pay period.

Create the type of pay that works for your business—you can customize by shift, weights, multiple compensation types, and more.

Create a pay schedule that fits the needs of your business and your team.

Calculate the right deductions including pre-tax or post-tax deductions for your team.

Automatically calculate the right benefits deductions, including the employee and employer percentage split.

Accurately calculate garnishment withholding and automatically send payments to government agencies.

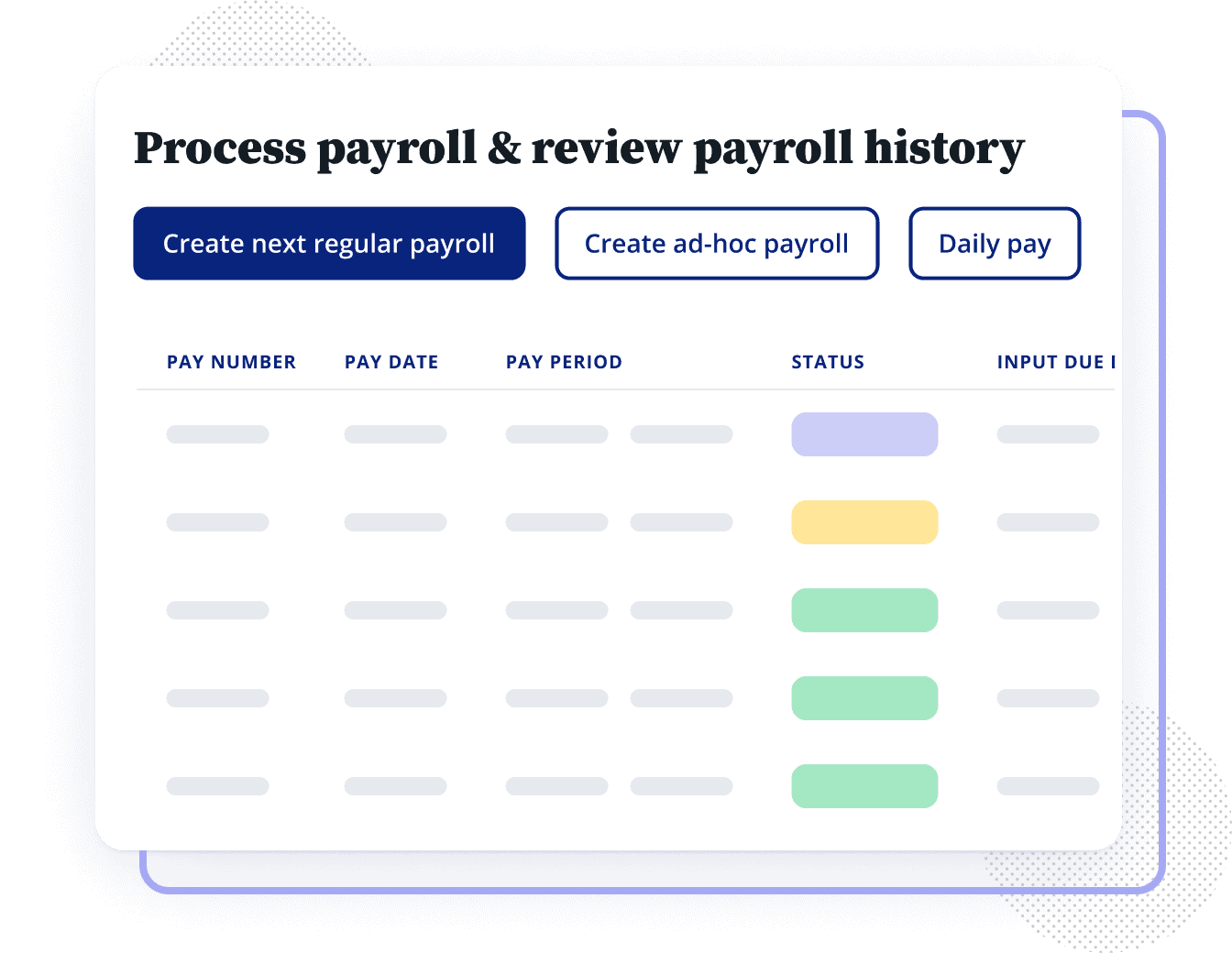

Run payroll whenever you need to, with no restrictions whatsoever.

Payroll Integrations

When you make a change in one part of the platform, the change is automatically reflected in all other parts, which means no time-consuming data re-entry.

Sync new hire information with payroll before an employee’s first day so they—and you—have less to worry about.

Don’t waste time on time off calculations. It’s all automatically calculated and synced with Payroll.

Track hourly time worked and time off—and have that information flow straight into Payroll.

Once employees enrol in benefits, we’ll calculate and sync deductions for you.

Rely on Rise and the tools you already work with, including Xero, QuickBooks, and FreshBooks.

Reporting

Look back on everything with a record of every payroll you’ve run.

Generate and download standard or custom reports whenever you need them, including the payroll register, year-to-date, remittance, and journal entry reports.

Generate payroll reports that can be directly imported into your accounting systems.

Understand how much you’re paying for labour for different positions and projects.

Compliance

Go paperless and worry less. We’re connected to all government agencies and automatically file EHT and CRA remittances for you.

Send employees their T4s or T4As on time with our straightforward automated process.

Reconcile your T4/T4A/RL1 slips at any time throughout the year.

Don’t stress over compliance—our tax engine follows all Canadian regulations.