Your benefits, payroll, and HR finally in sync

Companies of all shapes and sizes rely on Rise. You can too.

We make benefits easy—for you and your employees. From choosing a plan to managing coverage, we simplify every step. Focus on what truly matters: supporting your people.

Be the company where people want to work and grow. Modern benefits show you care about your team, helping attract and retain the best talent.

All your Benefits, Payroll, and HR needs in one place. Say goodbye to errors, duplicate work, and missing data with everything seamlessly connected.

Rise Health is a very modern way of looking at a very, I would say, a traditional industry. We love using Rise Health. It takes just a minute to submit a claim!”

By signing up for Rise Health and consolidating onto a single platform, we were able to save both time and money!”

Say goodbye to fragmented systems

Navigate benefits your way

Worry-free benefits administration

Support that adapts

Canadian compliance covered

Recognized by

Benefits that put your team first

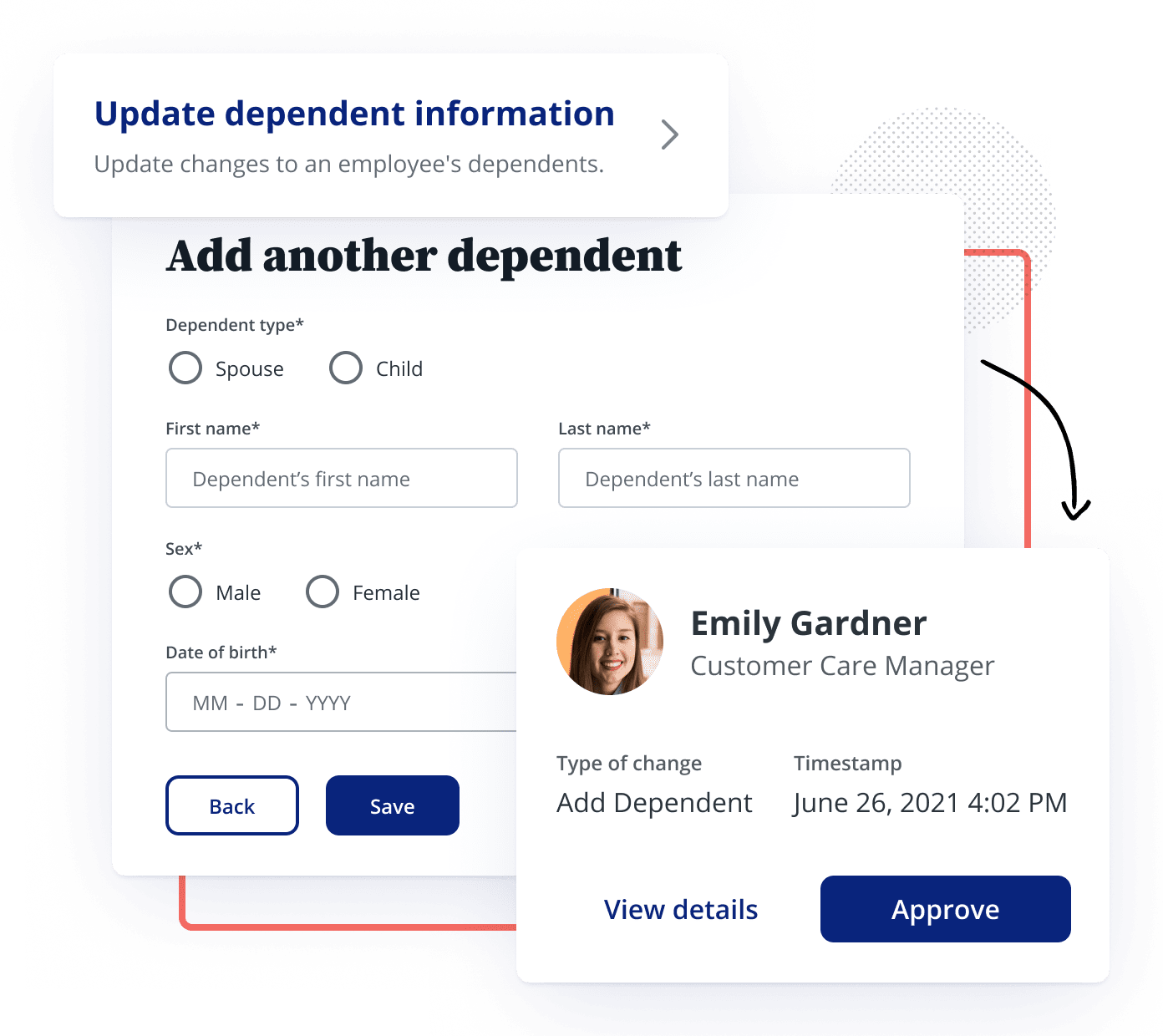

Your plan admin dashboard is your benefits command centre. View employee statuses, send reminder emails to enrol, update employee information, view plan booklets, and download eligibility reports.

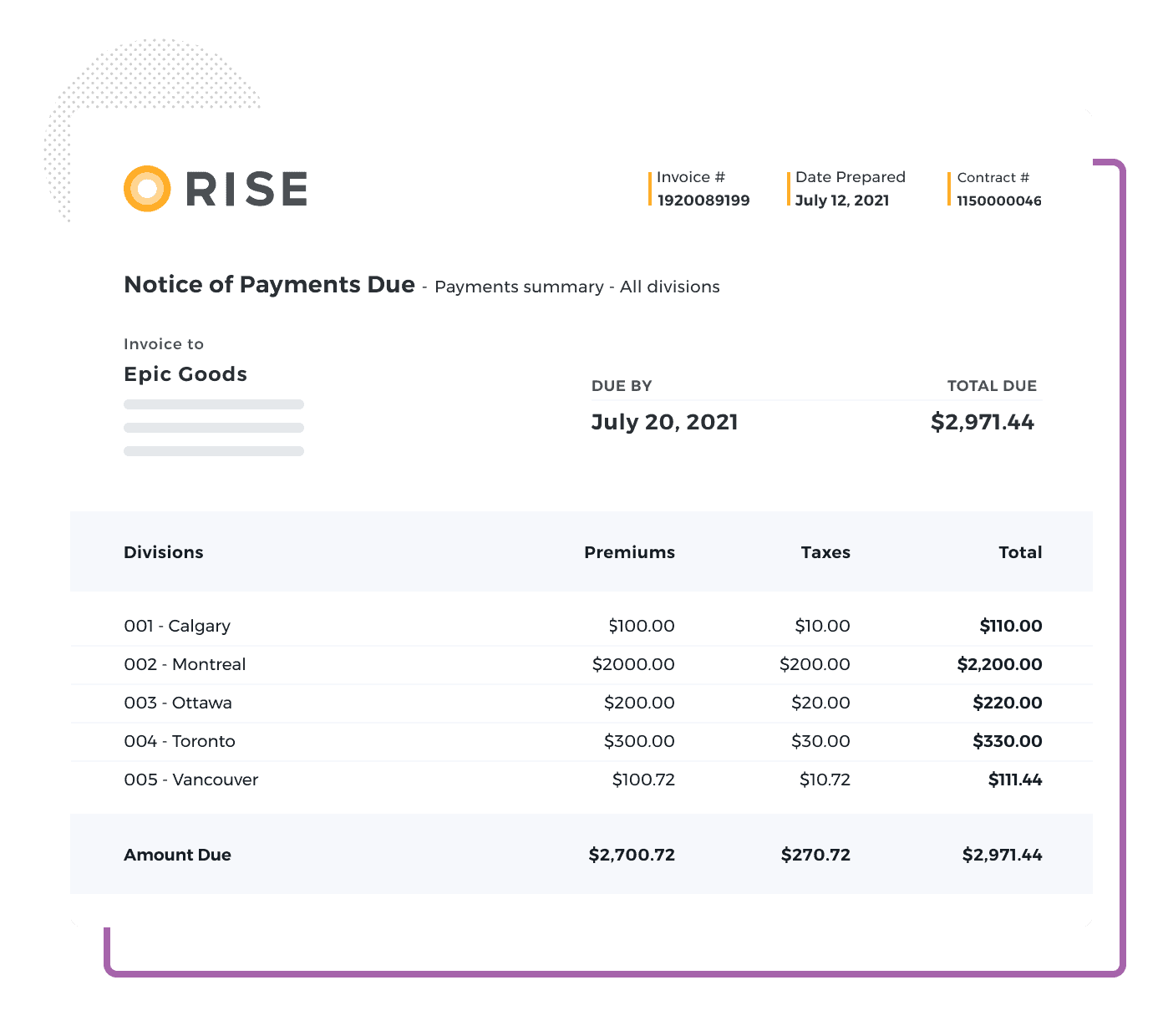

We like to keep it simple. Everything is on one, consolidated bill. You’ll only receive one monthly invoice and make one monthly payment. We’ll handle remitting payments to the carrier for you.

Our seamless group benefits platform puts an end to manual data entry and expedites the enrolment process. Which means that you and your employees can quickly get back to business.

Relieve business risk. Our benefits integrate with HR and payroll, so you’ll stay ahead of regulations and ensure your business is 100% compliant and never at risk.