With numerous different provincial requirements and federal guidelines, figuring out statutory holiday eligibility and pay is often a huge stumbling block when processing payroll.

While many pieces of payroll software can do the heavy lifting for you, there are inevitably exceptions that muddy the waters. And it’s important as people and culture professionals to have a thorough understanding of how eligibility is determined. Statutory holiday pay is often a massive payroll expense and knowing how to mitigate it can result in significant payroll savings.

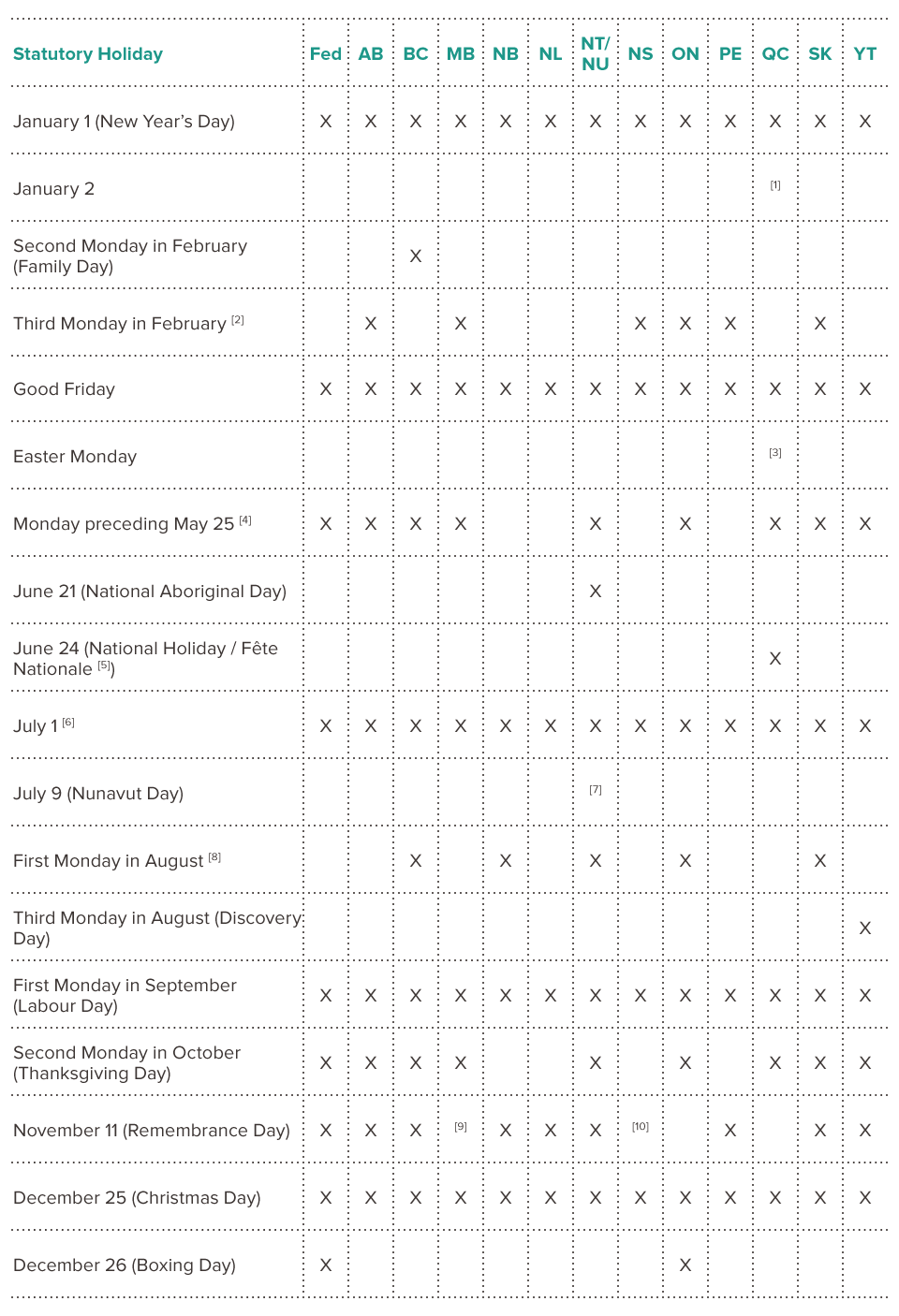

Holidays by Jurisdiction

We’ve broken Canada down into 13 jurisdictions, based on legislation. Note that the “Fed” jurisdiction applies to employees governed under the Canada Labour Code, Part III. This includes employees in federal industries relating to infrastructure, finance, transportation, telecoms, many First Nations activities, and most federal Crown corporations, to name a few. Employees who fall under the Canada Labour Code, Part III may not be entitled to statutory holidays in their province of employment, although their employer may choose to grant these as holidays.

1 Employees in the clothing industry (but not those who work in clothing stores) are entitled to also receive January 2 as a statutory holiday. Though not a legal requirement, it has become customary to give this day off to team members.

2 This holiday is known as Family Day in BC, AB, ON and SK; Louis Riel Day in MB; Islander Day in PE; and Heritage Day in NS.

3 Employers may choose to observe either Good Friday or Easter Monday. Employees in the clothing industry (but not those who work in clothing stores) receive both.

4 This holiday is known as Patriots’ Day in QC and Victoria Day elsewhere.

5 If June 24 is a Sunday and the team member does not normally work Sunday, this holiday falls on June 25.

6 Known as Memorial Day in NL and Canada Day elsewhere. If July 1 is a Sunday, the holiday is moved to July 2.

7 July 9 is Nunavut Day and is a paid holiday for government employees only.

8 Known as BC Day, NB Day, and SK Day in their respective provinces. It is a Civic Holiday elsewhere and a non-statutory holiday unless noted. Employers may close their operations at their own discretion.

9 While most businesses remain closed, it is not necessary to pay team members statutory holiday pay (although many employers opt to). Team members permitted and required to work this day are paid a premium (see the section on MB for specific details).

10 Team members are entitled to take the day off but may not be paid for it. Team members who work Remembrance Day and have worked 15 of the last 30 calendar days immediately preceding Remembrance Day may be entitled to receive their regular wages, plus a holiday with pay taken at the end of a vacation or another agreed upon time.

Rules by Jurisdiction

We’ll delve a little deeper into the rules for each jurisdiction, covering:

Holiday Substitution: the rules governing if and how a statutory holiday can be substituted for another day.

Business Closures: what businesses are required to close on which statutory holidays.

Eligibility Criteria: what requirements a team member must satisfy in order to receive statutory holiday pay.

Statutory Holiday Pay: how to calculate pay for the holiday. This is generally divided into two types of pay:

» “Statutory Holiday Pay,” granted to eligible team members regardless of whether they worked the stat

» “Statutory Holiday Premium,” granted to eligible team members who work the stat, often in addition to “Statutory Holiday Pay.”

Eligible Earnings: which earnings are included in statutory holiday pay calculations.

How Shift Work Is Affected when a shift straddles a non-statutory holiday and a statutory holiday.

How Overtime Pay Is Affected by a statutory holiday.

How Pay Days Are Affected when a statutory holiday lands on them. Please note that it is common practice to pay team members before the holiday if pay day falls directly on it. Quebec is the only province that legislates this, but it is good practice nonetheless.

Federal Employee Stat Holiday Regulations

Holiday Substitution

An employer may substitute any day, as long as the affected team members agree in writing. In practice, a team member may substitute a day so long as the employer consents.

Business Closures

The Canada Labour Code, Part III makes provisions for what it terms “continuous operations.” These are businesses and/or Crown corporations that run with no regard for the weekend. They include television, radio, telephone and internet providers, along with segments of the transportation industry. In the vast majority of cases, these operations must continue running on stat holidays.

Note that some groups of team members in a “continuous operation” business may be exempt. Consider a trucking enterprise: while drivers or mechanics are necessary to the day-to-day operation of the business, various support staff, such as administrative assistants or payroll clerks, are not.

For more information on “continuous operations,” please see this fact sheet.

Businesses that do not or are not required to operate on the weekend but are subject to the Canada Labour Code, Part III—banks or Canada Post, for instance—are not considered continuous and therefore not required to operate on statutory holidays.

Eligibility Criteria

In order to receive stat holiday pay, team members must have:

» Been employed at least 30 days

» Reported to work on the holiday if considered a “continuous operations” employee

Statutory Holiday Pay

When the holiday is not worked:

The team member is paid a regular daily wage, calculated using 1/20th of the wages earned in the preceding 4 weeks.

For team members who are paid at least partly by commission and who have been employed more than 12 weeks, a regular daily wage is calculated using 1/60th of the wages earned in the preceding 12 weeks.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay (see above) plus 1.5 times the regular rate for hours worked.

If employed in a continuous operation, the team member is paid regular rate for any hours on the holiday and may be given another day off with pay.

Managers and professionals must be given a holiday with pay at some other time.

When the holiday falls on a non-working day:

A regular day off with pay should be added to the team member’s vacation or granted at another time.

When New Year’s Day, Canada Day, Remembrance Day, Christmas Day, or Boxing Day falls on a weekend day that is a non-working day, a day off with pay must be granted on the work day immediately preceding or following the holiday (except when Canada Day falls on a Sunday—then the following Monday is observed as a holiday).

Eligible Earnings

Wages excluding overtime:

Wages include premium pay for overtime hours worked (e.g. the “half” of the “time and a half”), premium pay for the time worked on general holidays, pay for general holidays (the pay for “not worked”), pay in lieu of general holidays, bereavement leave pay, vacation pay, pay pending an employer’s decision on maternity leave/reassignment, and any other remuneration (monetary or non) that a team member is contractually entitled to for work performed.

Shift Work

Only hours worked on the holiday are considered eligible for stat pay, regardless of the start or end of the shift.

Impact on Overtime Calculations

» The maximum hours required for overtime are decreased by one average working day of the team member

» The statutory holiday is not included in overtime calculation.

Impact on Pay Day

The team member must be paid on established day and within 30 days of statutory pay entitlement.

Stat Holiday Regulations for Alberta Employees

Holiday Substitution

Employers may substitute any holiday, provided that the substitution date falls after the actual holiday and not before.

Note: when Canada Day falls on a Sunday, the holiday is already substituted to Monday.

In general practice, the employer should notify team members of this change well in advance.

Business Closures

Most business remain open, though with reduced hours, on statutory holidays. There is no law requiring businesses to close.

Eligibility Criteria

In order to receive stat pay, team members must have:

» Worked at least 30 days in the preceding 12 months (most employers will count approved leaves of absence such as vacation or maternity as “worked” days)

» Worked the scheduled shift before and after the holiday (unless the employer has approved an absence)

» Worked on the holiday, if asked

And

» The holiday must fall on a regular work day

Note: If the team member has worked that day at least 5 of the previous 9 weeks, it is considered a regular work day)

Note: Construction workers are not eligible for stat pay, as they receive an extra 3.6% holiday pay on their gross wages.

Statutory Holiday Pay

When the holiday is not worked:

The team member is paid an average daily wage. For team members with irregular schedules, the average daily wage is determined by the preceding 9 weeks.

When the holiday falls on a regular work day and is worked:

The team member is paid an average wage, as above, plus 1.5 times their regular daily rate

OR

The team member is paid regular wages, plus a day off with pay before the team member’s next annual vacation, on a regular work day.

Team members paid by commission or other incentive-based pays (e.g. mileage, piecework) are entitled to an average daily wage, plus 1.5 times the hourly wage. For team members paid solely with incentive-based pay, their wage is deemed to be the minimum wage; if paid partly by salary and partly by incentive-based pay, their wage is the greater of their actual salary and the minimum wage.

When the holiday falls on a non-working day:

The team member receives 1.5 times regular rate for any hours worked without statutory holiday pay and no other day off. If the team member does not work the day and it is a regular day off, there is no holiday entitlement to the team member.

Eligible Earnings

Regular wages, excluding overtime, vacation pay, statutory holiday pay and termination pay. All other wages should be included.

Shift Work

If the shift begins on a holiday, the entire shift—regardless of end time—is considered for holiday pay. If the shift begins on a non-holiday, no hours in the shift should be considered for holiday pay.

Impact on Overtime Calculations

None.

Impact on Pay Day

Team members must be paid within 10 days from the end of the period.

Stat Holiday Regulations for British Columbia Employees

Holiday Substitution

Any holiday can be substituted with team member and employer consent. Individual team members may consent to substitution or a general substitution can be applied with approval from the majority of all team members. Any such agreement must be written and kept on file for at least 2 years.

Business Closures

Most business remain open, though with reduced hours, on statutory holidays. There is no law requiring businesses to close.

Eligibility Criteria

Team members must have:

» Been employed for at least 30 days

» Worked or earned wages (including vacation pay) on at least 15 of the 30 days before the statutory holiday (unless under an averaging agreement or other variance in the 30-day period)

Statutory Holiday Pay

When the holiday is not worked:

The team member receives at least an average day’s pay, calculated by dividing the total wages in the 30 preceding days by the number of days worked.

When the holiday falls on a regular work day and is worked:

The team member receives an average day’s pay, plus 1.5 times the regular rate for the first 12 hours worked and 2 times the regular rate for additional hours.

When the holiday falls on a non-working day:

The team member receives statutory holiday pay or a regular working day off with pay, to be taken no later than the next annual vacation.

Eligible Earnings

Total wages, excluding overtime, but including vacation pay.

Shift Work

If the shift begins on a holiday, the entire shift—regardless of end time—is considered for holiday pay. If the shift begins on a non-holiday, no hours in the shift should be considered for holiday pay.

Impact on Pay Day

Team members must be paid within 8 days from the end of the period

Stat Holiday Regulations for Manitoba Employees

Holiday Substitution

Substitution is allowed with consent from the majority of team members. However, certain businesses are not permitted to be open on certain holidays, listed below.

Business Closures

In general, only the following types of business may be open on a holiday (or a Sunday), without a by-law exception*:

» Businesses that regularly employ fewer than four team members (including the owner)

» Restaurants

» Pharmacies

» Laundromats

» Boat and motor vehicle rental, repair and service shops

» Places with educational, recreational or amusement purposes

» Tourism and recreational facilities, including summer resorts

» Retail stores selling nursery stock, flowers or garden supplies and accessories; fresh fruit and vegetables; or gasoline and related goods for motor vehicles

These businesses are permitted to be open on holidays, using Sunday shopping hours. Retail businesses not included above are not permitted to be open on New Year’s Day, Good Friday, Easter Sunday, Canada Day, Labour Day, or Christmas Day. In addition, retail businesses may not be open between 9:00 AM and 1:00 PM on Remembrance Day.

For more information, consult the Manitoba Employment Standards Act Holiday Fact Sheet, the Retail Businesses Holiday Closing Act, and The Remembrance Day Act.

*Note: Winnipeg has a by-law exception

Eligibility Criteria

Team members must have:

» Worked the last scheduled work day before and after the holiday, unless the absence is due to illness or the team member has the consent of their employer

» Agreed to work on the holiday falling on a regular work day, if expected to do so

Statutory Holiday Pay

When the holiday is not worked:

The team member receives 5% of their total wages from the 4 week period preceding the holiday.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay and 1.5 times the regular hourly rate for hours worked. In continuous operations, the employer and team members may agree to regular daily wages, plus another day off with pay.

Team members required to work on Remembrance Day are paid for at least half of a normal work day at 1.5 times their regular wages. Consult the Remembrance Day Act for more information.

When the holiday falls on a non-working day:

The team member receives a regular day off with pay, no later than the next annual vacation. If the holiday falls on a weekend that the team member does not normally work, they are entitled to the next regular work day off with pay.

Eligible Earnings

Regular wages, including vacation pay and any other benefits the team member is entitled to, but excluding overtime.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

Holiday hours are included in overtime calculations.

Impact On Pay Day

Team members must be paid within 10 working days from the end of the period.

Stat Holiday Regulations for New Brunswick Employees

Holiday Substitution

Any holiday can be substituted with another day off, provided there is written mutual agreement and the substituted day is taken no later than the start of the team member’s next vacation period. Note that in continuous operations such as hotels or tourist resorts, the employer does not require the team member’s agreement and may schedule another working day off.

Business Closures

The New Brunswick Days of Rest Act specifies that retail businesses must be closed on Sundays (unless there is a local by-law exception) and on the ten prescribed days of rest:

» New Year’s Day

» Good Friday

» Victoria Day

» Canada Day

» New Brunswick Day

» Labour Day

» Thanksgiving Day

» Remembrance Day

» Christmas Day

» Boxing Day

Most retail businesses must be closed on these days. Notable exceptions include emergency services, manufacturing industries, places of worship, recreation establishments and many types of small convenience stores and pharmacies. For a full list of exceptions, please see this list.

Eligibility Criteria

In order to receive stat pay, team members must:

» Have been employed at least 90 calendar days in the 12 months preceding the holiday (unless returning from an employer-approved leave)

» Have worked the scheduled shift before and after the holiday, unless there is good reason for not doing so

» Have worked the scheduled shift on the holiday after agreeing to do so, unless there is good reason for not

» Not be employed under an arrangement wherein the team member can decide when and when not to work

Statutory Holiday Pay

When the holiday is not worked:

The team member receives their regular daily wage, based on the preceding 30 days. Employers may also opt to pay team members a 3% statutory holiday benefit on gross wages, so long as they identify it as such.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay (unless they’re receiving a 3% benefit as indicated above), plus 1.5 times their regular hourly rate.

When the holiday falls on a non-working day:

The team member receives statutory holiday pay (unless they’re receiving a 3% benefit as indicated above)

OR

The team member receives a regular day off with pay, to be taken no later than the next annual vacation.

Eligible Earnings

Regular wages excluding overtime, unless the overtime is considered regular or scheduled. Other wages to be included are salary and commission, but not vacation pay, pay in lieu of vacation or statutory holidays, statutory holiday pay, gratuities or honoraria.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

Holiday hours are included in overtime calculations.

Impact On Pay Day

Team members must be paid within 7 days from the end of the period.

Stat Holiday Regulations for Newfoundland & Labrador Employees

Holiday Substitution

No substitution policy exists, with the exception of Canada Day.

Business Closures

Most retail businesses are not permitted to open on the following days:

» New Year’s Day

» Good Friday

» Easter Sunday

» Victoria Day

» Memorial Day or Canada Day (July 1)

» Labour Day

» Thanksgiving Day

» Remembrance Day

» Christmas Day

» Boxing Day

» Regatta Day, in St. John’s and Harbour Grace

» Any day fixed by council as a public holiday in any other town or city

The Shops Closing Act does allow for exemptions to the above closings, specifically for convenience stores, book shops, restaurants and pharmacies, among others, but even exempt stores are generally prohibited from selling clothing and electronics.

For more information, please consult Newfoundland and Labrador’s Labour Relations Agency.

Eligibility Criteria

In order to receive stat holiday pay, team members must have:

» Been actively employed at least 30 calendar days preceding the holiday

» Worked the scheduled shift before and after the holiday

Statutory Holiday Pay

When the holiday is not worked:

Regular daily wage, calculated using the last 3 weeks of earnings.

When the holiday falls on a regular work day and is worked:

The team member can decide to either receive 2 times their regular wage

OR

Regular pay for hours worked, plus one day off added to their annual vacation or taken within the next 30 days.

If the holiday shift is shorter than their regular work day, the entitlement is regular wages for the hours worked, plus their regular daily wage.

When the holiday falls on a non-working day:

The team member receives another mutually agreed upon day off with pay, or the next working day off with pay.

Eligible Earnings

Regular wages including overtime, vacation pay and holiday pay, but excluding tips and gratuities.

Shift Work

Only hours worked on the holiday are considered eligible for stat pay, regardless of the start or end of the shift.

Impact On Overtime Calculations

The holiday is included if worked and excluded if not.

Impact On Pay Day

Team members must be paid within 7 days from the end of the period.

Stat Holiday Regulations for Nunavut Employees

Holiday Substitution

Any holiday may be substituted, provided there is written consent with affected team members.

Business Closures

Most business remain open, though with reduced hours, on statutory holidays. There is no law requiring businesses to close.

Eligibility Criteria

In order to receive stat holiday pay, team members must have:

» Worked 30 days in the preceding 12 months

» Reported to work on the holiday if requested to do so

» Worked the scheduled work day preceding and following the holiday, unless they have employer’s consent not to

Eligible team members are entitled to holiday pay while on:

» Bereavement leave

» Sick leave

» Court leave not exceeding 10 days

Statutory Holiday Pay

When the holiday is not worked:

The team member receives their regular daily wage, calculated using the last 4 weeks of earnings.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay, plus 1.5 times their regular rate

OR

The team member receives regular pay for any hours worked, plus a day off with pay no later than the next annual vacation.

When the holiday falls on a non-working day:

The team member receives statutory holiday pay, or a regular day off with pay no later than the next vacation.

Eligible Earnings

Regular wages including vacation, overtime and statutory holiday pay, but not gratuities.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

The holiday is not included in overtime calculations.

Impact On Pay Day

Team members must be paid within 10 days from the end of the period.

Stat Holiday Regulations for Northwest Territories Employees

Holiday Substitution

Any holiday may be substituted, provided there is written consent with affected team members.

Business Closures

Most business remain open, though with reduced hours, on statutory holidays. There is no law requiring businesses to close.

Eligibility Criteria

In order to receive stat holiday pay, team members must have:

» Worked 30 days in the preceding 12 months

» Reported to work on the holiday if requested to do so

» Worked the scheduled work day preceding and following the holiday, unless they have employer’s consent not to

Eligible team members are entitled to holiday pay while on:

» Bereavement leave

» Sick leave

» Court leave not exceeding 10 days

Statutory Holiday Pay

When the holiday is not worked:

The team member receives their regular daily wage, calculated using the last 4 weeks of earnings.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay, plus 1.5 times their regular rate

OR

The team member receives regular pay for any hours worked, plus a day off with pay no later than the next annual vacation.

When the holiday falls on a non-working day:

The team member receives statutory holiday pay, or a regular day off with pay no later than the next vacation.

Eligible Earnings

Regular wages including vacation, overtime and statutory holiday pay, but not gratuities.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

The holiday is not included in overtime calculations.

Impact On Pay Day

Team members must be paid within 10 days from the end of the period.

Stat Holiday Regulations for Nova Scotia Employees

Holiday Substitution

Any holiday may be substituted, provided there is written consent with affected team members. In addition, any substitutions must receive approval from the Director of Employment Standards.

Business Closures

Most retail stores are not permitted to open on the following holidays:

» New Year’s Day

» Nova Scotia Heritage Day (as of 2015)

» Good Friday

» Easter Sunday

» Canada Day

» Labour Day

» Remembrance Day

» Thanksgiving Day

» Christmas Day

» Boxing Day

The above holidays, except for Remembrance Day, fall under the Retail Business Designated Closing Day Act. Remembrance Day falls under the Remembrance Day Act and has different exemption rules. In general, small stores such as pharmacies and convenience stores are permitted to be open during certain hours.

Halifax has a municipal bylaw that only allows retail operations to be open between 9:00 AM and 6:00 PM on Natal Day, except for stores that are exempt from the Retail Business Designated Closing Day Act itself.

Eligibility Criteria

In order to receive stat pay, team members must have:

» Earned wages on at least 15 of the preceding 30 calendar days before the holiday (paid sick or vacation time included)

» Worked the scheduled shift preceding and following the holiday, unless otherwise instructed not to

Statutory Holiday Pay

When the holiday is not worked:

The team member receives their regular daily wage, calculated using the preceding 30 days.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay plus 1.5 times their regular rate for hours worked. If employed in a continuous operation, the employer may choose to pay the team member their regular hourly rate and give another day off with pay.

When the holiday falls on a non-working day:

The team member receives their next regular day off with pay or receives an extra day off with pay on their next vacation or at a time that the employer and team member agree to.

Eligible Earnings

Regular wages including salaries, commission, piecework and statutory holiday pay, but excluding vacation pay or pay in lieu of vacation.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

The holiday is included if worked (including Remembrance Day), but excluded if not. Note that if the holiday hours push the team member over the weekly overtime threshold, the additional hours should be calculated at half the regular rate, since these hours have already been paid at 1.5 times the regular pay rate.

Impact On Pay Day

Team members must be paid within 5 calendar days from the end of the period.

Stat Holiday Regulations for Ontario Employees

Holiday Substitution

An employer may substitute any day, as long as the affected team members agree in writing. In practice, a team member may substitute a day so long as the employer consents.

Business Closures

Most retailers may not open on the following days:

» New Year’s Day

» Family Day

» Good Friday

» Easter Sunday

» Victoria Day

» Canada Day

» Labour Day

» Thanksgiving Day

» Christmas Day

Certain municipal by-laws may grant specific exemptions. In addition, most small book or magazine stores, gas stations, pharmacies and flower shops are also exempt.

For more information, consult the Retail Business Holidays Act.

Eligibility Criteria

Team members must have:

» Worked their full shift before and after the holiday

» Worked the entire shift on the holiday if requested to do so

Statutory Holiday Pay

When the holiday is not worked:

The team member receives 1/20th of earnings from the last 4 work weeks, based on the employer’s work week.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay, plus 1.5 times the regular rate for each hour worked on the holiday (if the team member agrees in writing). If the team member fails to work the agreed upon hours without reasonable cause, the team member is not entitled to the additional statutory holiday pay.

OR

The team member receives statutory holiday pay, plus an additional day off with pay, to be taken no later than three months after the holiday (or up to twelve months if the team member agrees in writing).

When the holiday falls on a non-working day:

The team member receives statutory holiday pay.

OR

The team member receives a working day off with pay, taken no later than the next vacation.

Eligible Earnings

Regular wages excluding overtime, but including vacation pay payable (e.g. if the team member receives vacation pay on every paycheque, is on vacation pay or receives a lump-sum vacation pay payout).

Shift Work

If the shift begins on a holiday, the entire shift—regardless of end time—is considered for holiday pay. If the shift begins on a non-holiday, no hours in the shift should be considered for holiday pay.

Impact On Overtime Calculations

The holiday is not included, unless it is paid at the regular pay rate.

Impact On Pay Day

Must be paid on the regularly established pay day.

Stat Holiday Regulations for Prince Edward Island Employees

Holiday Substitution

No substitution policy exists in the relevant employment standards legislation, with the exception of Canada Day.

Business Closures

Most retailers are not permitted to be open during the following holidays:

» New Year’s Day

» Islander Day

» Good Friday

» Canada Day

» Labour Day

» Thanksgiving Day

» Remembrance Day

» Christmas Day

» Boxing Day

The Retail Business Holidays Act governs this, and provides exemptions for restaurants, pharmacies, convenience stores, gas stations, tourist facilities, drug stores and similar operations.

Note: this act also forbids non-exempt retailers from being open between 12:00 am and 11:59 am on Sundays.

Eligibility Criteria

Team members must have:

» Been employed for 30 calendar days before the holiday

» Earned wages on at least 15 of the 30 calendar days preceding the holiday

» Worked the scheduled shifts before and after the holiday, unless otherwise instructed not to

» Worked the holiday if agreed to do so; or had reasonable cause not to work the holiday

» Not had the option to refuse work

Statutory Holiday Pay

When the holiday is not worked:

The team member receives their regular daily wage, calculated using the last 30 days.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay, plus 1.5 times the regular rate for hours worked

OR*

The team member receives regular wages, plus a day off with pay (with the equivalent number of hours worked), taken no later than the next vacation.

*This decision is made by the employer

When the holiday falls on a non-working day:

The team member receives a regular day off with pay, taken no later than the next vacation.

Eligible Earnings

Regular wages, including salary, commission, overtime, and piecework, but excluding vacation pay, pay in lieu of vacation or gratuities.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

The holiday is not included in overtime calculations.

Impact On Pay Day

Team members must be paid all wages no more than 5 working days after the pay period ends.

Stat Holiday Regulations for Quebec Employees

Holiday Substitution

No substitution policy exists in the relevant employment standards legislation, except when June 24 or July 1 fall on a Sunday, in which case they are to be observed on the following Monday.

Business Closures

Most retailers are not permitted to be open on the following holidays:

» New Year’s Day

» Easter Sunday

» National Holiday/ Fête Nationale

» Canada Day

» Labour Day

» Christmas Day

This is governed by An Act Respecting Hours and Days of Admission to Commercial Establishments and provides exemptions for certain small retailers such as pharmacies, grocery stores, and restaurants.

Eligibility Criteria

For all holidays except National Holiday, team members must have:

» Worked the scheduled shift before and after the holiday, unless absent with a valid cause or employer consent

For National Holiday, team members must have:

» Been employed on the holiday

» Worked their scheduled shift on the holiday if required to do so

Statutory Holiday Pay

When the holiday is not worked:

The team member receives 1/20th of earnings from the last 4 weeks. For commissioned team members, the payment must be 1/60th of the wages earned in the last 12 weeks.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay, plus regular rate for hours worked

OR*

The team member receives regular rate for hours worked, plus a day off with pay within 3 weeks of the holiday. On National Holiday, the day off must be the work day immediately before or after the holiday.

*This decision is made by the employer

When the holiday falls on a non-working day:

The team member receives statutory holiday pay or a working day off with pay, taken before the next annual vacation. For National Holiday, the day off must be taken immediately before or after the holiday.

Eligible Earnings

Regular wages, excluding overtime.

Shift Work

Only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

Impact On Overtime Calculations

The hours are included only if the holiday falls on a normal work day or if the holiday is worked.

Impact On Pay Day

Team members must be paid at least once every 16 days. If the holiday falls on a pay day, the team members must be paid their wages before the holiday.

Stat Holiday Regulations for Saskatchewan Employees

Holiday Substitution

Any holiday may be substituted, provided there is written consent and the majority of team members have agreed. In addition, any substitutions must receive approval from the Director of Employment Standards.

Business Closures

Most business remain open, though with reduced hours, on statutory holidays. There is no law requiring businesses to close.

Eligibility Criteria

» Worked within 4 weeks prior to the holiday

Statutory Holiday Pay

When the holiday is not worked:

The team member receives regular daily wage, calculated using 1/20th of the wages earned in the preceding 4 weeks.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay, plus 1.5 times the hourly rate for hours worked.

When the holiday falls on a non-working day:

The team member receives their regular daily wage, calculated as above. However, if New Year’s Day, Christmas Day, or Remembrance Day falls on a Sunday, the following Monday is granted as a day off with pay.

Eligible Earnings

Regular wages including annual holiday pay, but excluding overtime.

Hourly paid construction employees receive 4% of all gross wages, excluding annual holiday pay and overtime, earned each calendar year as public holiday pay.

Shift Work

Only hours worked on the holiday are considered, regardless of the start or end of the shift.

Impact On Overtime Calculations

The holiday is not included in overtime calculations.

Impact On Pay Day

Team members must be paid within 6 days from the end of the period.

Stat Holiday Regulations for Yukon Territories Employees

Holiday Substitution

Any holiday can be substituted with team member and employer consent.

Business Closures

Most business remain open, though with reduced hours, on statutory holidays. There is no law requiring businesses to close.

Eligibility Criteria

If the team member worked the holiday:

» The team member is eligible for holiday pay

Otherwise, the team member must have:

» Been employed at least 30 calendar days before the holiday

» Reported to work on the holiday if requested to do so

» Worked the scheduled day before and after the holiday, unless absent with employer’s consent or permitted by the Employment Standards Act

» Not been on an employee-requested unpaid absence for 14 consecutive days immediately before the holiday, with the exception of maternity leave

Statutory Holiday Pay

When the holiday is not worked:

The team member receives their regular daily wage, calculated as 10% of the wages in the 2 calendar weeks immediately preceding the holiday.

When the holiday falls on a regular work day and is worked:

The team member receives statutory holiday pay as above, plus 1.5 times the regular rate of pay

OR

The team member receives their regular rate of pay, plus one paid day off.

When the holiday falls on a non-working day:

The team member receives the next regular day off with pay.

Eligible Earnings

Regular wages, excluding vacation pay. This includes any remuneration paid to the employee for work, plus travel allowances prescribed under the Employment Standards Act. It excludes gratuities, as well as any payment not tied to production, efficiency or hours of work.

Shift Work

If the shift begins on a holiday, the entire shift—regardless of end time—is considered for holiday pay. If the shift begins on a non-holiday, no hours in the shift should be considered for holiday pay.

Impact On Overtime Calculations

The holiday is not included in overtime calculations.

Impact On Pay Day

Team members must be paid within 10 days from the end of the period.

Conclusion

There you have it—our guide to statutory holiday pay in every jurisdiction in Canada!

We’ve done our best to cover every possible situation, but there will be exceptions to every rule—the calculations for managers or for certain types of agricultural workers, for instance, can vary from province to province. These laws change from time to time and so it’s impossible to cover every circumstance. If you’re at all unsure, don’t hesitate to ask us or to consult with your province’s Employment Standards Act.

Remember also that in nearly every case, you only need to meet or exceed the provincial statutory requirements (known as the “greater right or benefit”). Similar to offering additional vacation or personal days to team members, giving “greater” holiday benefits can also help you to cover your bases.

Here are a few other helpful tips:

Be compliant: every labour relations board has a phone number you can call and ask specific questions – make sure you’re not breaking the rules!

Get it in writing: most provinces allow for holiday substitutions, but you need to make sure both you and the affected team members know what’s going on.

Work with your team members: some team members love working holidays because of the extra pay, while others would prefer to enjoy a day off. Develop internal policies with this in mind.

Consider implementing the “greater right or benefit”: by waiving certain eligibility requirements—such as dropping the “15 in 30” rule in certain jurisdictions, for instance—you can make it easier to be compliant. You’ll ensure no one gets missed—and win some bonus points with your part-time staff.

Be fair: when possible, allow for equal treatment of holidays for non-Christian team members who may not celebrate Christmas Day or Good Friday. Various Human Rights Commissions have determined that unless doing so causes undue hardship on the employer, such accommodations should be made.